If life teaches us anything, it’s that you don’t get very far without a plan. Now that your days of pursuing a career are over, it’s more important than ever to have a solid plan for the next phase of your life.

According to the Fidelity Retiree Health Care Cost Estimate, a single person aged 65 in 2023 may need approximately $157,500 saved (after tax) to cover health care expenses in retirement. An average retired couple may need around $315,000. So, when it comes to retirement planning, is there a way to maximize your opportunities to enjoy life while considering the rising cost of health care?

A, B and D of Medicare Coverage

One way to cover future care costs is Medicare. Here’s a brief overview of what each one covers:

- Part A covers hospital costs after you meet a deductible.

- Part B is optional coverage for medical expenses and requires an annual premium. If you didn’t get Part B when you were first eligible, your monthly premium may go up 10% for each 12-month period you could’ve had Part B but didn’t sign up. Also, the penalty increases the longer you go without Part B coverage.

- Part D is for prescription drug coverage.

- Medicare Advantage plans are all-in-one managed care plans that provide the services covered under Part A and Part B of Medicare and may also cover other services that are not covered under Parts A and B, including Part D prescription drug coverage.

- Long-term care insurance (LTCI) is a private policy to help cover the costs of some types of health care not covered by Medicare. Like life insurance, the younger you are when you purchase LTCI, the less it will cost.

Benefits of Life Care

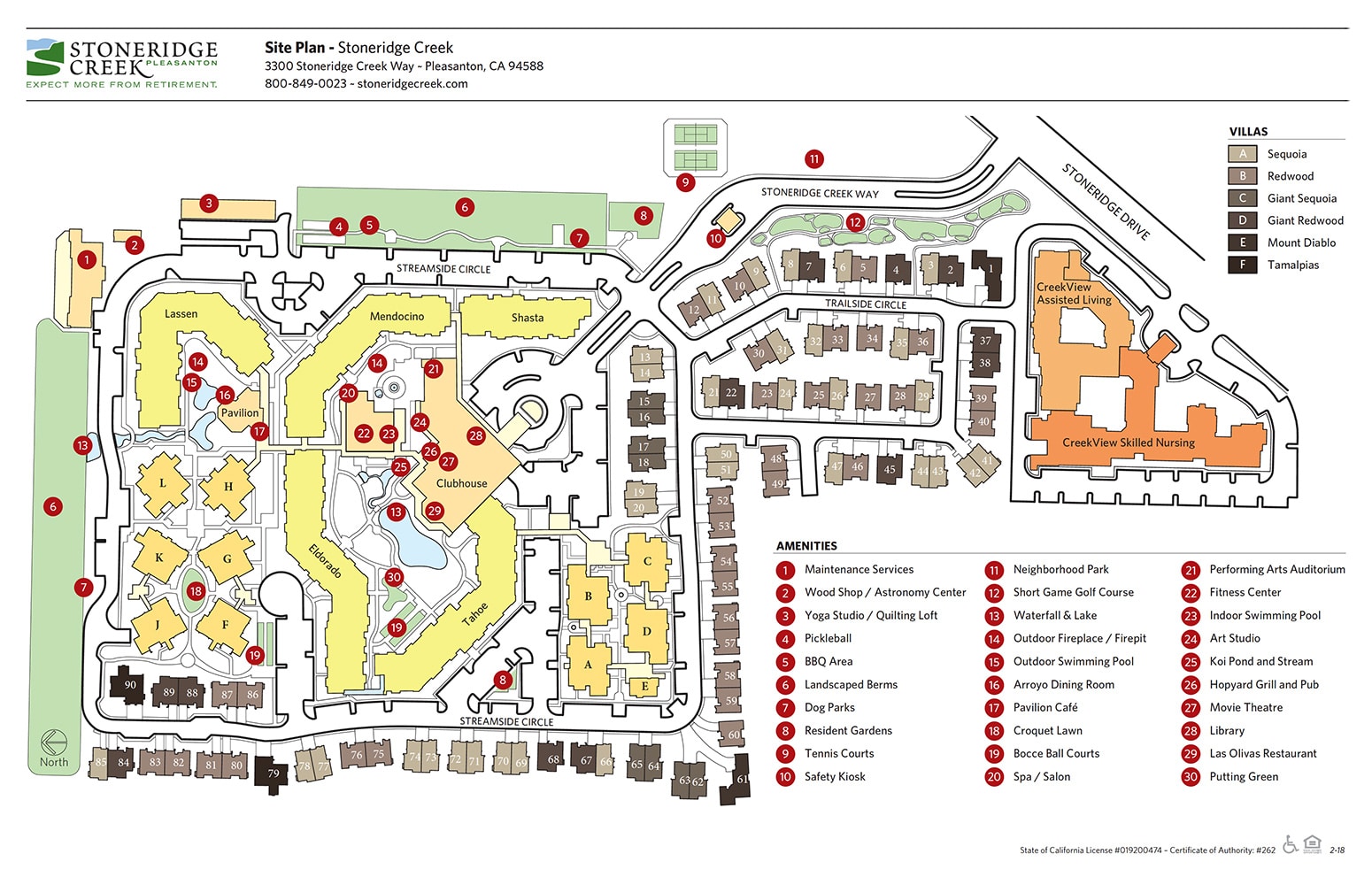

Life Care (also known as Type A) is a community contract option that helps you plan for the costs of long-term care at more predictable monthly rates while providing you with an engaging and active lifestyle. All Life Care communities — like Stoneridge Creek — are also Life Plan Communities, which is paid for with a one-time entrance fee plus a monthly fee. However, not all Life Plan Communities offer the full financial benefits of Type A Life Care.

Add Predictability to An Unpredictable World

While no one has a reliable crystal ball to tell you what the future holds, with the right planning you can have more financial control of your budget. With Life Care, not only will you know in advance what your expenses for care will be month to month, but if you or your spouse needs a higher level of care, you’ll still pay about the same. The only added expense will be to cover the cost of additional meals.

Does Your Retirement Plan Include a Type A Contract?

Stoneridge Creek has helped thousands of seniors find a smart, practical plan that works for them today and tomorrow. Our Type A contract offers secure and simple retirement planning. If you have questions about contract types or want to talk about your options, give us a call or contact us here. We’d love to show you around Stoneridge Creek and give you a feel for our lifestyle.